Your Nonprofit's Audience is King! Part 2: How to Learn More About Your Current Market

In part 1 of my blog article series, Your Nonprofit’s Audience is King!, I stressed the importance of knowing who your current audience is -- your donors and supporters -- and the need to segment and learn more about their demographics.

In part 1 of my blog article series, Your Nonprofit’s Audience is King!, I stressed the importance of knowing who your current audience is -- your donors and supporters -- and the need to segment and learn more about their demographics.

Now, let’s look at better understanding you constituents’ demographics and psychographics, and how that will help you develop your stories and calls to action, and inform the most appropriate multi-channel mix for your campaigns and strategies.

Your Constituents’ Demographics

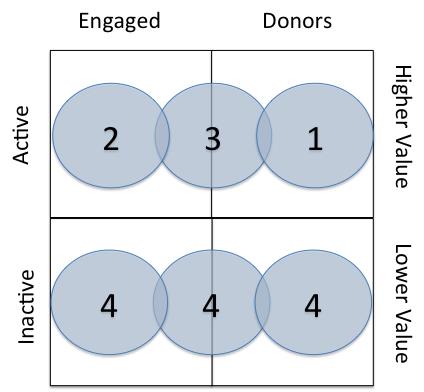

Homing in on your constituents’ demographics, along with transactional knowledge of the audience, can really help shape your strategies and tactics. Previously, we identified four primary audience segments:

- Donors

- Actively engaged or interested, but not donors

- Both 1 and 2 above

- Lapsed – or passive 13+months

We know that there could be an infinite number of subsets to these segments -- however, if we can learn more about each of the four segments at a high level, and which traits differentiate them from each other, we are well on our way to developing meaningful and data-informed marketing strategies.

The four segments are a combination of behavioral and transactional groupings. These groupings alone are fairly powerful, but when appending additional demographic data, you get the added value of having strength and confidence when developing your integrated marketing plan.

Adding Demographic Information to Your Audience List

Marketers have two basic options to choose from when considering the demographics of their file:

- Provide every segment list to a vendor and have them run a profile on each segment. This is a great option and will provide you with some directional information.

- Work with a vendor and identify the key demographic attributes you would like to append to your file. Keep in mind that budget considerations may make this decision for you.

By directly appending demographic and psychographic attributes to your file, you will have the additional flexibility to:

- Develop your own profiles -- who is donating or taking actions and to which offers. This knowledge can inform both your cultivation and acquisition list strategies.

- Create subsets -- if you began to see trends within the above four segments, you may want to create subsets. For example, a subset could be men respond better to certain types of appeals vs. women.

- Optimize segmentation -- demographics combined with transactional data (Recency, Frequency, Monetary, or RFM) can help identify profitable sections within an RFM segment that was historically deemed as unprofitable. By reviewing demographic data next to unprofitable and profitable transaction data, new testing ideas may blossom in addition to fine-tuning your segmentation strategy.

The most popular and actionable demographic attributes that may be appended tend to be: gender, age, marital status, ethnicity and household income. Age is probably your most important attribute, as it can begin to shed light on a constituent’s lifestage. Generally speaking, when developing a fundraising strategy, you need to market to constituents with some means to give, which often means an older group. For advocacy campaigning, however, you could target younger supporters. This is a great example of how demographic data and your four segments will begin to drive new strategies and planning developments.

Stay tuned to this blog for part 3 – How to identify your best donors and bind them to your mission.

Share, Like and Post | | Article Link | CommentYour Nonprofit's Audience is King!

In the world of integrated marketing, many of us have heard the mantra, “know your audience.” The audience (your current market) may not be the new black, but it is the quiet King. It should be the focal point of everything related to your strategic planning, reporting and creative and messaging development.

We are in a world where retention is a primary focus because many of our donors aren’t being emotional involved or moved enough to stay. Controls and one size fits all approaches are boring them.

So often we lose sight of our current market and undervalue them by not considering who they are and what their needs may be. Many organizations approach creative packages as an instrument to increase response and only later home in on their segmentation strategies. A trap many of us have fallen into is believing that our messages are relevant to everyone – they’re not. Every relationship matures and evolves over time and so should your relationships with your supporters.

This is the first article in a 3-part series in which I’m going to discuss how to build a multi-channel, integrated high value donor management program.

There are three macro themes to the series:

- How to properly identify groupings of audiences that are segment-able within most systems

- A variety of approaches that will help us learn about our current audience segments and creating personas

- How to identify your best donors and develop or enhance communications that will increasingly bind them to your organization’s mission

Let’s start with No. 1: How to properly identify groupings of audiences that are segment-able within most systems.

We'll start by using one simple goal as our guide: Increase retention of high value current market audiences. Current market audiences are those supporters and donors that have already opted in to hear from your organization. They have either donated recently, opted in to received emails from you recently, are an active volunteer or are active readers of your emails and newsletters.

The first step in identifying audience groupings of your current market is to distinguish between behaviors:

- Donors

- Actively engaged or interested, but not donors

- Both 1 and 2 above

- Lapsed – or passive 13+months

In this first step, our ultimate objective is to separate our constituents by behavior level and then learn some basic psychographic and demographic information about each. From there we can begin to identify motivations by segment and plan strategies to better cultivate them.

Current Market Segments:

Segments 1 and 3 have a dollar value that can be assigned to them, as they are both donors. Segment 2 is a not donor, but has potential dollar value as they may be an active email subscriber, or a political or social advocate and just have not yet donated. Segments 1, 2 and 3 are your current market. Segment 4 are 13+ month inactive and but hold potential future value to the organization using re-engagement strategies.

Upcoming posts will build upon these segments and will focus on:

- How to learn more about your current market

- Identifying the donors you need to retain

- Building an integrated cultivation program to move, retain and upgrade constituents

- KPIs and how to measure the impact of an integrated cultivation program

Finding Long Term Value for Nonprofits in a Multichannel World

This article was written by guest authors Angelo Licursi, Vice President, Research Advisory Services, Paradysz, and Philip Fertick, Director of Acquisition and New Media, Feeding America.

We live our lives in an omnichannel manner; we consistently, and fluidly, move between online, offline, social, and direct means and resources to achieve our daily demands. In following suit with these evolving cultural norms and habits, fundraising programs are no longer relegated to direct, siloed channels, but now operate in an omnipresent environment where all channels influence and interact with one another.

We live our lives in an omnichannel manner; we consistently, and fluidly, move between online, offline, social, and direct means and resources to achieve our daily demands. In following suit with these evolving cultural norms and habits, fundraising programs are no longer relegated to direct, siloed channels, but now operate in an omnipresent environment where all channels influence and interact with one another.

In addition to adapting to this multilayer approach, nonprofits now also have to battle fierce and growing competition for fundraising dollars. Donors today have more options to support a cause near and dear to their hearts because of the oncoming wave of nonprofit organizations entering the scene. With more choices and more technological resources to interact, donors are inundated with fundraising opportunities, and nonprofits must continuously strive to differentiate their organization and their ask.

Nonprofits no longer have the option of dabbling in multichannel campaigns – it is now a prerequisite. However, despite these increasing demands for omnipresent engagement, many organizations are asking their fundraising teams to “do more with less,” to find ways to grow the program without the supporting budget to do so. To meet this challenge, nonprofits need to maximize the potential ROI for every fundraising initiative, channel and campaign.

Feeding America Goes Multichannel

Feeding America, the nation’s leading domestic hunger relief charity, recently underwent changes that resulted in re-focused organizational initiatives around digital and multichannel strategies. Direct mail, while traditionally the most successful avenue for acquiring new donors, and also the most expensive avenue, was still providing the organization with a steady and unrestricted stream of revenue, however, new online donor metrics were performing better. Online donors responded to acquisitions and asks with higher average gifts than their offline counterparts.

As Feeding America focused on looking ahead to align with donors’ increasingly digital-first mindsets, they also had to accommodate the challenge of not abandoning core components of their audience who still prefer traditional direct mail. Feeding America looked to improve the long term value of ALL their programs. Investing and testing in multiple environments allowed Feeding America to more accurately determine where their higher value donors engaged and how best to facilitate continuous engagement. To implement the testing and deployment of long term value based campaigns, Feeding America turned to their fundraising partners including multichannel agency, Paradysz.

Paradysz, working in tandem with Feeding America and their fundraising partner, Thompson Habib Denison, determined that improving ROI can start with acquiring higher value donors. Lifetime value analysis showed that direct mail acquired donors that give more in acquisition tend to stay on file longer and give more over the course of their lifecycle.

From there, Paradysz developed a streamlined targeting acquisition solution to upgrade the value of new donors. Offer-to-audience test strategy focused on targeted ask array among high gift prospect segments to maximize their giving potential, and ultimately to improve the ROI on the direct mail acquisition efforts. This implementation resulted in a 40% lift in gross revenue from high value segments as well as a 64% lift in gift averages from marrying higher asks to higher value audiences.

Extending the Giving Relationship

Some organizations make the mistake of thinking that a donor’s established giving value is at maximum capacity, but in reality, it’s possible to extend the giving relationship beyond set giving amounts and enhance the long term value of the donor relationship. Additionally, adopting an acquisition strategy that targets prospects likely to contribute higher long term value can also be implemented to develop more significant and sustainable relationships. To distinguish and cultivate those donors correctly, organizations should follow these three key steps:

- Investing in donor analytics that answers the following questions:

- Who are your best donors?

- How do you acquire them?

- What relationships are you cultivating with them?

- Developing streamlined segmentation and targeting practices that build off the key findings from your donor analysis.

- Testing new marketing techniques (offer, ask, channel, season cadence, etc.) to maximize the ROI from your segmentation and targeting practices.

Nonprofits should not be afraid to ask for what they want – higher gift values – but in asking for more, they need to consider who to ask, how to ask and how much to ask for. Implementing a sound long-term value plan through analytics, segmentation and continual testing gives organizations the insights they need to develop long term relationships with high value returns.

Share, Like and Post | | Article Link | CommentShriners Hospitals for Children Turn a Teddy Bear into a Brand

A teddy bear – we’ve all had one. It’s the iconic toy found in the arms of small children, and often adored by people of all ages.

A teddy bear – we’ve all had one. It’s the iconic toy found in the arms of small children, and often adored by people of all ages.

Shriners Hospitals for Children (SHC) turned an average teddy bear into a well-known brand ambassador, raising thousands of dollars to care for children in need – along with a nomination for the 2014 IMAB Integrated Marketing Award.

Shriners Hospitals is a network of 22 nonprofit facilities serving children regardless of their families’ ability to pay. Children with orthopaedic conditions, burns, spinal cord injuries, and cleft lip and palate receive the highest quality care and treatment in a family-oriented environment. Teddy bears may be used by SHC medical staff to educate a child prior to surgery, or children may receive a bear when they enter the hospital to help the patient focus on something other than their surgery. The use of teddy bears has long embodied the organization’s commitment to kid-centric education and comprehensive care, and helps the healing process for thousands of patients each year.

Last fall, SHC wanted to introduce their first brand ambassador – an icon recognizable to children and families that represents the love shown to all children receiving care at any of their locations. A teddy bear was the natural choice. On National American Teddy Bear Day, SHC launched a multi-channel campaign introducing Fezzy the teddy bear as the first Love to the rescue® brand ambassador. But before the big announcement, internal challenges had been overcome.

Teddy Bear Brings Departments Together

Like many organizations, most departments within SHC work independently, and rarely do their efforts overlap. The biggest challenge of this campaign was the effort required to bring all departments and stakeholders together to launch a successful campaign. With the help of their direct marketing agency, CDR Fundraising Group, and public relations firm First Degree, SHC staff worked together to communicate, collaborate and achieve their common goal ― make Fezzy the teddy bear a nationwide symbol of love to children and families.

The organization first engaged their audience through a Facebook vote to choose the name of this bear, appealing to online supporters of all ages. 3,000 votes later (with more than 14,900 likes and 2,500 comments), the teddy bear was named Fezzy. SHC then introduced Fezzy as their first Love to the rescue® brand ambassador through a press release and targeted emails to their network of supporters.

A Toy, a Brand, and a Symbol of Love

Fezzy quickly became popular and was featured on both the Today Show and Fox and Friends. SHC capitalized on this media presence by using targeted keywords in their search engine marketing to help people searching for Fezzy find out more about him, with the opportunity to order their very own bear.

The successful campaign included a custom landing page, drawing more than 11,200 visitors with an average time on page of more than 3 minutes. The email component also contributed to the impressive campaign performance, as the two messages saw high open rates and click through rates ― from an email file that was previously not considered active.

To date, more than 960 four-foot tall bears have been sold to raise funds for the Shriners network of facilities. This multichannel campaign not only raised thousands of dollars for children’s healthcare, but Fezzy has in fact brought love to hundreds of children nationwide.

Share, Like and Post | | Article Link | CommentAdvocates as Donors Part 2: Activation and Conversion

This article was written by Molly Brooksbank, Senior Director of Digital Engagement at Sierra Club. Sierra Club is an IMAB Nonprofit Member.

In my last article, I wrote about building your nonprofit’s prospect list as the first part of a strategy to convert advocates to donors. Now, I’m tackling the next steps: activation and conversion.

In my last article, I wrote about building your nonprofit’s prospect list as the first part of a strategy to convert advocates to donors. Now, I’m tackling the next steps: activation and conversion.

Nearly every ROI discussion on this topic I’ve seen focuses exclusively on converting advocates to donors and leaves out retaining people as advocates. Let’s face it, at least in the short term there is going to be a steep drop off between name acquisition and donor conversion -- but let’s not sell advocates who aren’t (yet) donors short.

Some sources you may work with provide a great stream of solid and highly engaged advocates and volunteers, but have lower conversion to donors. Some provide both. Your mix should reflect your unique goals, so build your ROI model accordingly. You may also be able to use personas or predictive models to funnel advocates of different types into different messaging tracks designed to convert them to donors.

At the highest level though, there are still simple steps you can take to pick the advocates that have the highest likelihood for conversion. Assuming you have an email welcome series in place, you’ll want to map out when conversions are most likely to happen after a name is acquired. For the Sierra Club, we’ve found that two-thirds of the audience most likely to convert will do so within six months. Most come in after three months, but the long tail continues to return new donors for another 18 months. Asking for donations on the acknowledgement screens of your petitions is another tactic you can add to boost online fundraising 5-15% with minimal effort.

Keeping Activists Engaged

Key to both advocacy engagement and fundraising from advocates is keeping activists engaged in the reasons they first came to your organization. That means keeping campaign arcs fresh and focused, as well as introducing messaging tracks specifically focused on activation and reactivation.

There are a couple of ways to do this depending on the frequency with which you run online advocacy campaigns:

- If you do a lot of advocacy, you can send only those actions that have superior engagement (e.g. performing some set level above internal benchmarks).

- If you’re broadly appealing actions are a bit less frequent, you might select a regular period to send the best still-relevant actions out to this group.

What’s important here is relevance, to ensure people take actions. However the frequency of those actions has different implications on who you might target for fundraising.

For example, Sierra Club ran an exceptionally large paid acquisition program in 2012, which allowed us to do some good integrated testing of those names. We found that in the mail, people who had taken action 7-12 months prior were only slightly less warm than the four to six months group, which were a smidge better than zero to three months. But the distinction was not enough to not mail any of these groups. Nor did it matter in the mail how many actions they had taken, so long as they had taken at least one action after being acquired.

However, on the phone in converting to monthly donors , three to five online actions was the minimum to return results on names acquired through paid acquisition. And of course, this varied significantly by the paid source. As we’ve increasingly ramped up name acquisition from other sources, we’re seeing even better results from organic channels -- and as long as paid sources perform, there will always be a mix.

There’s also a long way to go, for Sierra Club and for many organization, in terms of balancing investment in growing the base of supporters across membership and other important forms of engagement. What kind of conversion results does your organization see? Got a great strategy for managing the balancing act between programs and fundraising? Share your thoughts in the comments section!

Share, Like and Post | | Article Link | Comment